Payment processing fees are everywhere.

There's a processing fee for any business owner accepting credit cards as a payment method through their Point of Sale system. Online payment processing services like Stripe and PayPal collect a small fee when processing payments, too.

Usually, credit card processing fees hover around a standard $0.30 plus 2.9% of every transaction. However, some merchants charge higher or lower, depending on the payment method.

Processing fees can be tricky to track - often, payment processing services deposit the sale amount minus any fees. If not correctly followed, looking at the deposit alone can result in inaccurate sales numbers and incorrect expenses.

How do you track credit card processing fees, and what's the best way to account for them within QuickBooks Online?

Start With Accurate Sales Figures

To fully understand how payment processing fees should be recorded in Quickbooks, we need to know how sales are recorded. If you're unfamiliar with how credits and debits work in a double-entry accounting system, you may want to check out this guide first.

Imagine you're a Software as a Service (SaaS) company that's built a scheduling app for mobile dog groomers. Your business uses a Monthly Recurring Revenue (MRR) model, so every time you get a new user, they pay $30 per month until they cancel.

This means your gross sales figures with just one paying user would be $30 in a given month. With 100 users, you'd be making $3,000 per month.

Every time a sale is made, an invoice is generated for the amount that your business expects to receive. An invoice records the services provided to your customer and the requirements for them to submit payment.

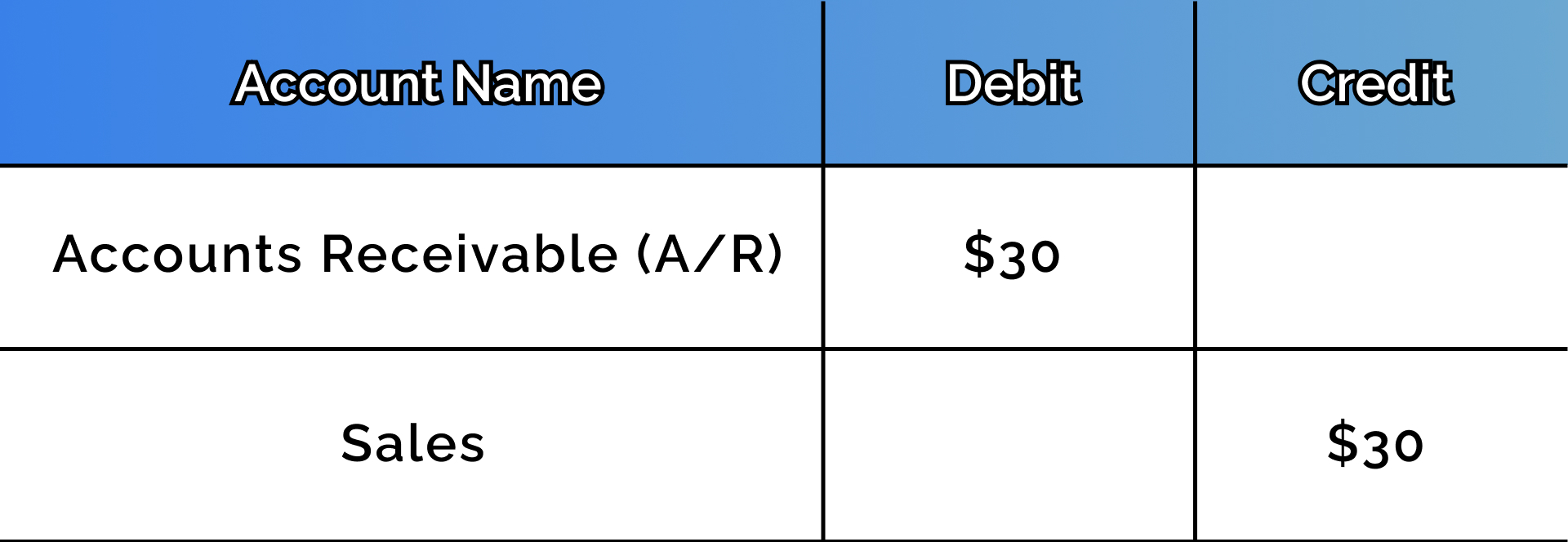

In an accounting system like QuickBooks Online, a simple invoice consists of a debit to Accounts Receivable (A/R) and a credit to a Sales account. This indicates that a sale has been made and that money is owed to your business.

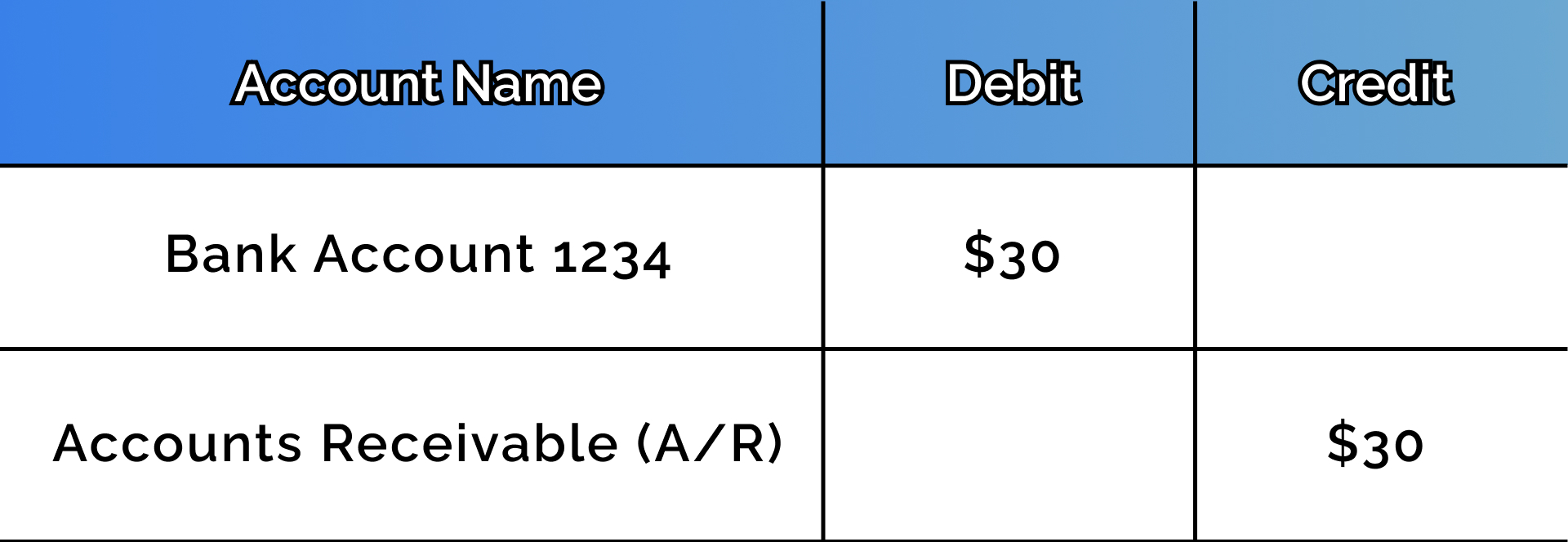

When your business receives a payment on that invoice, that payment can be recognized by debiting your Bank Account and crediting Accounts Receivable.

There's a problem here, though.

When your payment processor (Stripe, in this case) deposits money into your bank account, you don't receive $30.

Instead, your payment processor deposits the net amount of each transaction.

As I mentioned, most payment processors charge 2.9% + $0.30 per transaction. On a $30 transaction, that means you'd receive $28.83. For your entry to accurately reflect what happened in the bank, you must account for the credit card processing fee.

While your net sales amount is correct at $30 for this transaction, we need to change our Bank Account debit to $28.83 (the amount deposited) and include an expense of $1.17 (the processing fee). Typically, this expense can be booked to an account called "Bank Charges & Fees."

.jpg)

Fees Can be Costly

Many small business owners recognize income based on deposits to their bank accounts.

Recording every single fee that your business is paying according to the revenue that you're earning can feel highly tedious. Is getting it right down to the penny worth it?

In our example above, that would mean simply booking the $28.83 deposit from Stripe directly to Sales and calling it a day.

Unfortunately, this practice leads to an inaccurate representation of sales figures. Not correctly recognizing the processing fees associated with your revenue effectively lowers your gross income, devaluing your business, which can impact financing options, rent eligibility, and sales price.

You can accurately plan for growth in your business by adequately recognizing revenue and accounting for fees based on when they occur.

What to Do in QuickBooks Online

Luckily for us, the cloud accounting age has brought numerous options for automating the tedious, painstaking tasks that come along with revenue recognition.

Platforms like Bookkeep, Acodei, and Synder allow accountants and small business owners to automatically record invoice information from several online payment processors and sales platforms into QuickBooks Online.

Automation and technologies that allow you to sync payment information (and the associated fees) reduce room for human error and ensure you get the most accurate financial reporting possible.

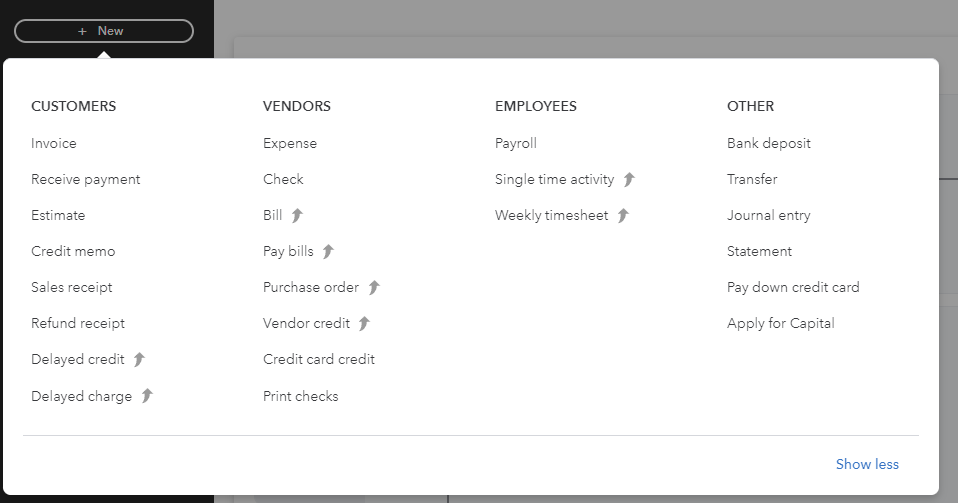

Recording and recognizing revenues in QuickBooks Online manually is a relatively simple process. You can create an invoice within QuickBooks for your customers by clicking the "New" button at the top left hand side of QuickBooks Online.

From here, select "Invoice" to start the process. QuickBooks allows you to create an invoice to send directly to your clients for payment.

You can even use QuickBooks Payments to automatically allow your customers to submit payments directly from their invoice portal!

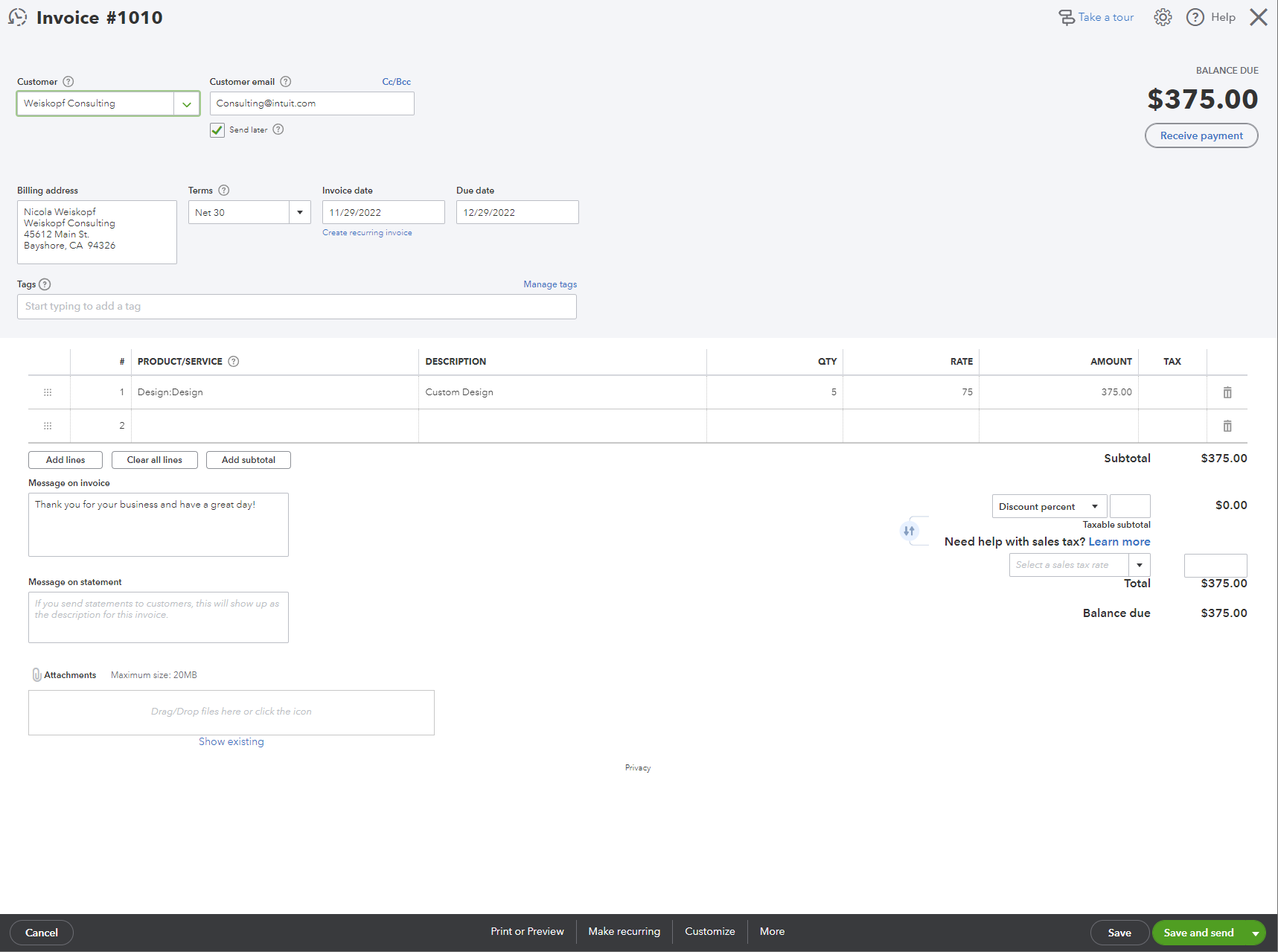

Include your customer's information, agreed-upon payment terms, and the products or services you're billing for in your invoice. Once you're ready to send the invoice, click "Save and Send."

If your payment is processed directly through QuickBooks, you'll be able to match that payment to the corresponding invoice automatically.

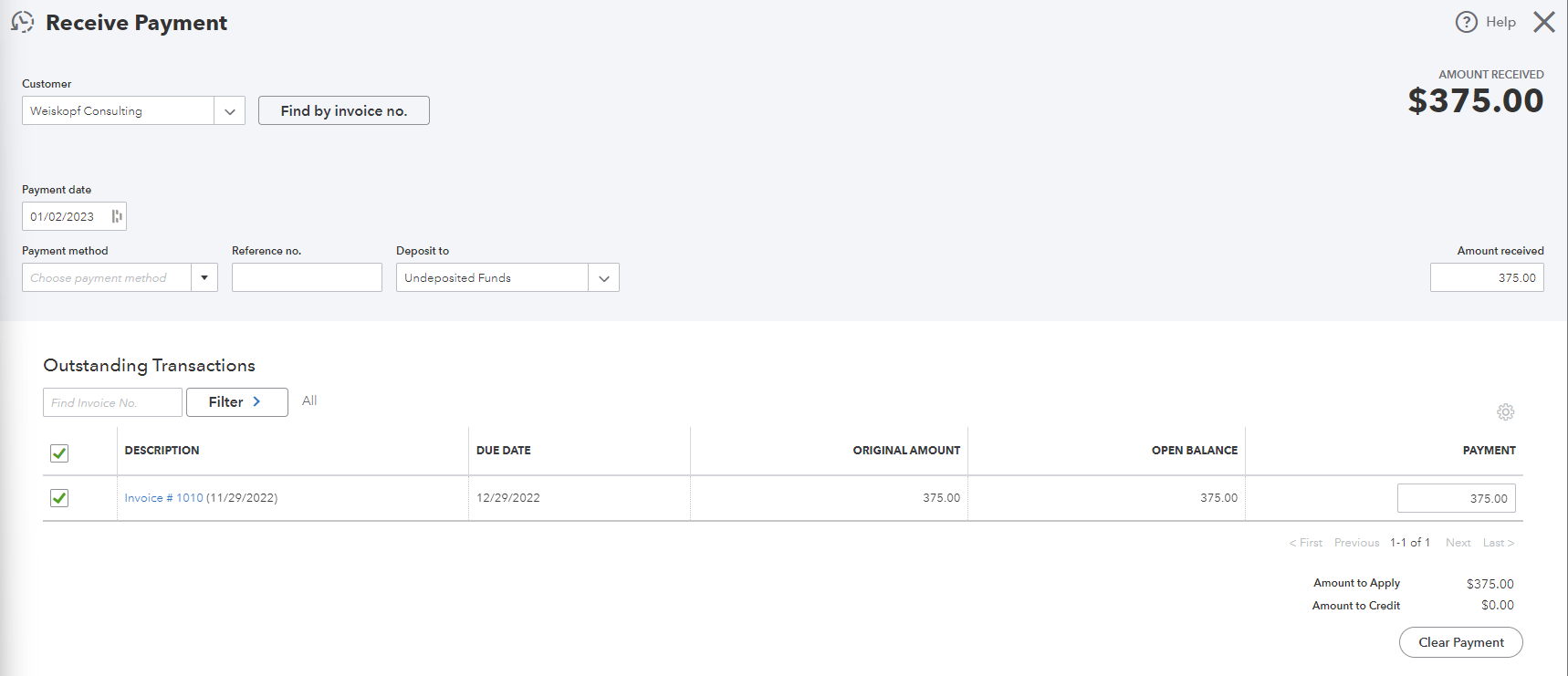

If your customer submits a payment for your invoice outside of QuickBooks Online, locate the "Invoices" tab and find the invoice you'd like to record a payment for.

Select the invoice in question and click "Receive Payment."

QuickBooks allows you to record and link the payment to the invoice. Select the "Deposit To:" dropdown and the corresponding account in which the payment appears. You may want to use the "Undeposited Funds" account if your payment is in transit.

Once your payment has been deposited to the account, you can manually record the deposit by creating a new bank deposit.

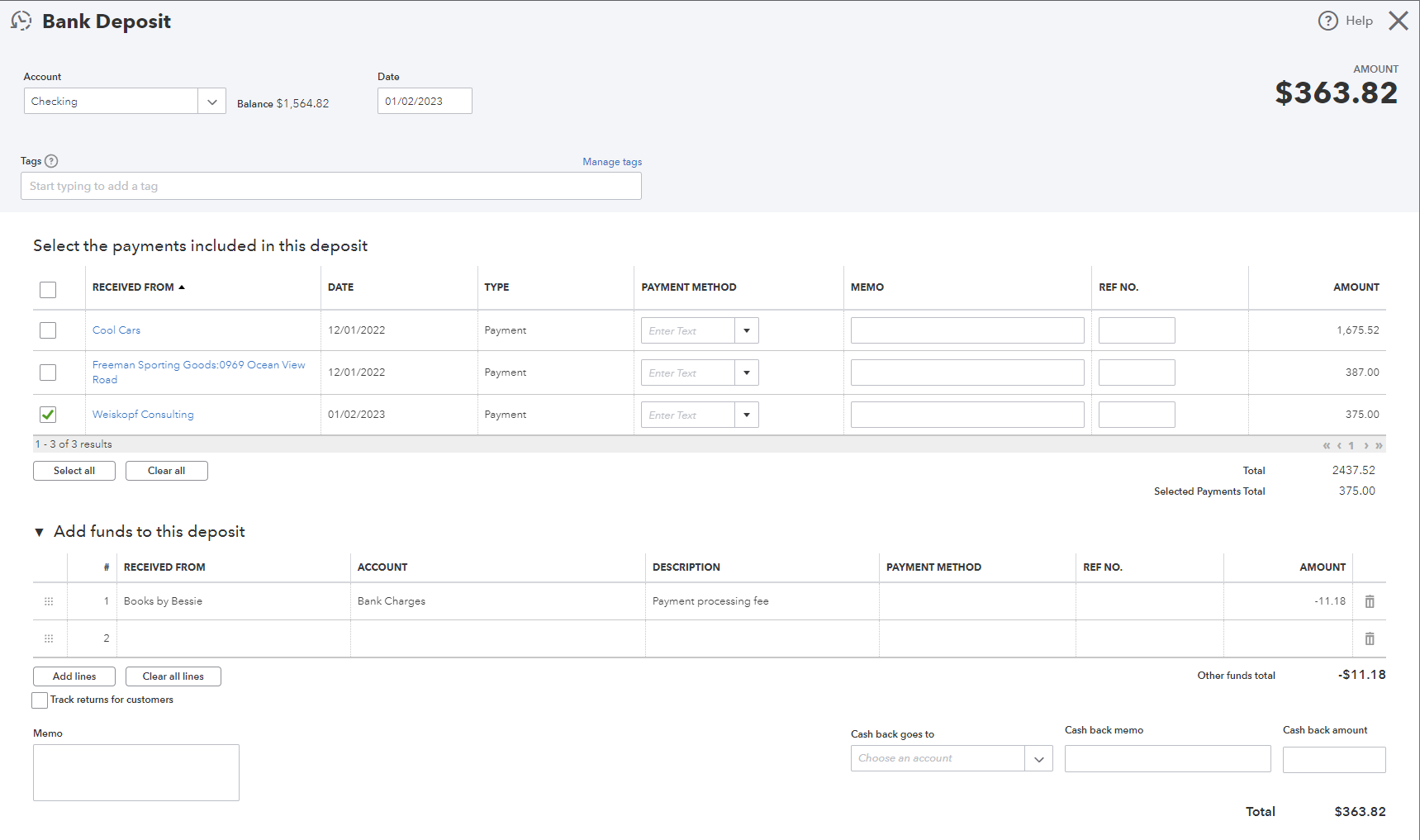

In the bank deposit screen on QuickBooks Online, select the payment included in the deposit you're entering.

To record the payment processing fee, enter the account information, description, and amount charged under the "Add Funds to This Deposit" section. A negative amount here will record the payment processing expense.

There you have it - you've created an invoice, recognized a payment, and subsequently recorded a deposit with the relevant payment processing fee!

This manual process can be significantly simplified with automation, saving time and increasing the accuracy of your financial statements. If you find yourself getting lost and struggling to properly account for things like credit card processing fees, it's time to work with a qualified accounting team like Amarlo!

Remember, this isn't tax advice.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Amarlo assumes no liability for actions taken in reliance upon the information contained herein.

Unlock your financial story today.

Get started